Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| EDITAS MEDICINE, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

EDITAS MEDICINE, INC.

11 Hurley Street

Cambridge, Massachusetts 02141

NOTICE OF 20172020 ANNUAL MEETING OF STOCKHOLDERS

To be held June 15, 201710, 2020

You are cordially invited to attend the 20172020 Annual Meeting of Stockholders (the "Annual Meeting") of Editas Medicine, Inc., which is scheduled to be held via the Internet at a virtual web conference at www.virtualshareholdermeeting.com/EDIT2020 on Thursday,Wednesday, June 15, 201710, 2020 at 1:00 p.m.8:30 a.m. Eastern time, attime. In light of the ongoing coronavirus disease of 2019 pandemic, we will be hosting our headquarters, 11 Hurley Street, Cambridge, Massachusetts 02141.Annual Meeting virtually to support the health and well-being of our stockholders, employees, directors, and other meeting participants. There will not be a physical meeting location, and stockholders will not be able to attend the Annual Meeting in person. Our stockholders are invited to attend virtually, the logistics of which are discussed more fully in the attached Proxy Statement. This means that you can attend the Annual Meeting online, vote your shares during the online meeting and submit questions during the online meeting by visiting the above-mentioned Internet site.

Only stockholders who owned common stock at the close of business on April 18, 201715, 2020 can vote atduring the Annual Meeting or any adjournment that may take place. At the Annual Meeting, the stockholders will consider and vote on the following matters:

You can find more information includingregarding the nominees for directors, in the attached Proxy Statement. The board of directors recommends that you vote in favor of each of proposals one and two as outlinedforegoing in the attached Proxy Statement.

Instead of mailing a printed copy of our proxy materials to all of our stockholders, we provide access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all stockholders. Accordingly, on or about April 26, 2017,28, 2020, we will begin mailing a Notice of Internet Availability of Proxy Materials or Notice,("Notice") to all stockholders of record on our books at the close of business on April 18, 2017,15, 2020, the record date for the Annual Meeting, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, stockholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail, or electronically by email, on an ongoing basis.

If you are a stockholder of record, you may vote in one of the following ways:

A complete list of registered stockholders will be available at least 10 days prior to the meeting for inspection at our offices at 11 Hurley St., Cambridge, MA 02141. This list will also be available to stockholders of record during the Annual Meeting for examination at www.virtualshareholdermeeting.com/EDIT2020. If your shares are held in "street name," that is, held for your account by a bank, broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

Whether or not you plan to attend the Annual Meeting in person,online, we urge you to take the time to vote your shares.

| By | ||

| ||

President and Chief Executive Officer |

Cambridge, Massachusetts

April 26, 201728, 2020

Editas Medicine, Inc.

Proxy Statement

| | Page | |||

|---|---|---|---|---|

Proxy Statement | 1 | |||

Important Information About the Annual Meeting and Voting | 2 | |||

Proposal No. 1—Election of | 6 | |||

Information Regarding Directors | ||||

Corporate Governance | 11 | |||

Director Nomination Process | 11 | |||

Director Independence | 12 | |||

Board Committees | 13 | |||

Board and Committee Meetings Attendance | 16 | |||

Director Attendance at Annual Meeting of Stockholders | 16 | |||

Code of Business Conduct and Ethics | 16 | |||

Corporate Governance Guidelines | 16 | |||

Board Leadership Structure and Board's Role in Risk Oversight | 16 | |||

Communication with our Directors | 17 | |||

Executive Compensation Compensation Discussion and Analysis | 18 | |||

Compensation Risk Assessment | 34 | |||

Compensation Committee Report | 34 | |||

Summary Compensation Table | 35 | |||

Grant of Plan-Based Awards | 38 | |||

Outstanding Equity Awards at Fiscal Year-End | 39 | |||

Option Exercises and Stock Vested | 40 | |||

Employment, Severance, Change in Control Arrangements, Separation and Consulting Arrangements | 41 | |||

Potential Payments upon Termination or Change in Control | 42 | |||

Compensation Committee Interlocks and Insider Participation | 44 | |||

Securities Authorized for Issuance Under Our Equity Compensation Plans | 46 | |||

Director Compensation | 45 | |||

Transactions with Related Persons | 48 | |||

Principal Stockholders | 50 | |||

Report of the Audit Committee | 53 | |||

Proposal No. 2—Advisory Vote on Executive Compensation | 54 | |||

Proposal No. 3—Ratification of the Appointment of Ernst & Young LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

Householding, | ||||

Stockholder Proposals | ||||

and Other Matters | ||||

EDITAS MEDICINE, INC.

11 Hurley Street

Cambridge, Massachusetts 02141

617-401-9000

PROXY STATEMENT

FOR THE 20172020 ANNUAL MEETING OF STOCKHOLDERS

to be held June 15, 201710, 2020

This proxy statement and the enclosed proxy card contain information about the Annual Meeting of Stockholders of Editas Medicine, Inc., or (the ("Annual Meeting") to be held via the Internet at a virtual web conference at www.virtualshareholdermeeting.com/EDIT2020 on Wednesday, June 10, 2020 at 8:30 a.m. Eastern time. In light of the ongoing coronavirus disease of 2019 pandemic, we will be hosting our Annual Meeting virtually to support the health and well-being of our stockholders, employees, directors, and other meeting participants. There will not be a physical meeting location, and stockholders will not be able to attend the Annual Meeting online. Our stockholders are invited to be held on Thursday, June 15, 2017 at 1:00 p.m. Eastern time, atattend virtually, the company's headquarters, 11 Hurley Street, Cambridge, Massachusetts 02141.logistics of which are discussed more fully in the attached proxy statement. This means that you can attend the Annual Meeting online, vote your shares during the online meeting and submit questions during the online meeting by visiting the above-mentioned Internet site. The board of directors of Editas is using this proxy statement to solicit proxies for use at the Annual Meeting. In this proxy statement, unless expressly stated otherwise or the context otherwise requires, the use of "Editas," "our," "we" or "us" refers to Editas Medicine, Inc. and its wholly owned subsidiary.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to be Held on June 15, 2017:10, 2020:

This proxy statement and our 20162019 Annual Report to Stockholders are

available for viewing, printing and downloading at http://www.proxyvote.com.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, or 20162019 (the "2019 Annual Report,Report") as filed with the Securities and Exchange Commission or SEC,("SEC"), except for exhibits, will be furnished without charge to any stockholder upon written request to Editas Medicine, Inc., 11 Hurley Street, Cambridge, Massachusetts 02141. This proxy statement and our 2019 Annual Report on Form 10-K for the fiscal year ended December 31, 2016 are also available on the SEC's website at http://www.sec.gov.

On or about April 26, 2017,28, 2020, we will mail a Notice of Internet Availability of Proxy Materials or Notice,("Notice") to our stockholders (other than those who previously requested electronic or paper delivery of proxy materials), directing stockholders to a website where they can access our proxy materials, including this proxy statement and our 20162019 Annual Report, and view instructions on how to vote online or by telephone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive access to those materials via e-mail unless you elect otherwise.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

At the Annual Meeting, our stockholders will consider and vote on the following matters:

As of the date of this proxy statement, we are not aware of any business to come before the Annual Meetingmeeting other than the first twothree items noted above.

Board of Directors Recommendation

Our board of directorsBoard unanimously recommends that you vote:

FOR the election of the threetwo nominees to serve as Class I directors on our board of directorsBoard, each for a three-year term;

FOR the approval, on an advisory basis, of the compensation of our named executive officers; and

FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.2020.

Availability of Proxy Materials

The Notice regarding our proxy materials, including this proxy statement and our 20162019 Annual Report, is being mailed to stockholders on or about April 26, 2017.28, 2020. Our proxy materials are also available for viewing, printing and downloading on the Internet at http://www.proxyvote.com.

Who Can Vote atduring the Annual Meeting

Only stockholders of record at the close of business on the record date of April 18, 201715, 2020, are entitled to receive notice of the Annual Meeting and to vote the shares of our common stock that they held on that date. As of April 18, 2017,15, 2020, there were 41,345,28554,982,559 shares of our common stock issued and outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

Difference between a "stockholder of record" and a beneficial owner of shares held in "street name"

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, then you are considered a "stockholder of record" of those shares. In this case, your Notice has been sent to you directly by us. You may vote your shares by proxy prior to the Annual Meeting by following the instructions contained on such Notice.

Beneficial Owners of Shares Held in Street Name. If your shares are held in a brokerage account or by a bank, trust or other nominee or custodian, then you are considered the beneficial owner of those shares, which are held in "street name." In this case, your Notice has been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that

organization as to how to vote the shares held in your account by following the instructions contained on the voting instruction card provided to you by that organization.

How to Vote

If you are a stockholder of record, you can vote your shares in one of two ways: either by proxy or in person atvirtually during the Annual Meeting. If you choose to vote by proxy, you may do so by telephone, via the Internet or by mail. Each of these methods is explained below.If you hold your shares of our common stock in multiple accounts, you should vote your shares as described in each set of proxy materials you receive.

Telephone and Internet voting prior to the Annual Meeting for stockholders of record will be available up until 11:59 p.m. Eastern time on June 14, 2017,9, 2020, and mailed proxy cards must be received by June 14, 201710, 2020 in order to be counted at the Annual Meeting. If the Annual Meeting is adjourned or postponed, these deadlines may be extended.

The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in "street name" will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization. Stockholders that own stock in "street name" as of the date may virtually attend the meeting and vote your shares online while attending the meeting with your control number included on your voting instruction form.

Ballot Measures Proposals Considered "Discretionary" and "Non-Discretionary"

If your shares are held in "street name," your bank, broker or other nominee may under certain circumstances vote your shares if you do not return voting instructions. Banks, brokers or other nominees are permitted to vote customers' shares for which they have received no voting instructions on specified routine, or "discretionary," matters, but they are not permitted to vote these shares on other non-routine, or "non-discretionary," matters.

The election of directors (Proposal No. 1) isand the advisory vote on the compensation of our named executive officers (Proposal No. 2) are considered a non-discretionary mattermatters under applicable rules. Therefore, if your shares are held in "street name," your bank, broker or other nominee cannot vote on this matterthese matters without voting instructions from you.you and your shares will be counted as "broker non-votes." The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 20172020 (Proposal No. 2)3) is considered a discretionary matter under applicable rules. Therefore, if your shares are held in "street name," your bank, broker or other nominee may exercise discretionary authority to vote on this matter in the absence of voting instructions from you.

If you do not instruct your bank, broker or other nominee how to vote with respect to the election of directors (Proposal No. 1), your bank, broker or other nominee may not vote with respect to this proposal and your shares will be counted as "broker non-votes." Broker non-votes are shares that are

held in "street name" by a bank, broker or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

Quorum

A quorum of stockholders is necessary to hold a valid meeting. Our amended and restated by-laws provide that a quorum will exist if stockholders holding a majority of the shares of stock issued and outstanding and entitled to vote are present at the meeting in personvirtually or by proxy. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

For purposes of determining whether a quorum exists, we will count as present any shares that are voted over the Internet, by telephone, by completing and submitting a proxy by mail or that are represented in personvirtually at the Annual Meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. In addition, we will count as present shares that are "broker non-votes."

A complete list of registered stockholders will be available at least 10 days prior to the meeting for inspection at our offices at 11 Hurley St., Cambridge, MA 02141. If you are unable to inspect this list in person, please contact our secretary by mail at Editas Medicine, Inc., 11 Hurley Street, Cambridge, Massachusetts 02141, Attention: Secretary, or by email at legal@editasmed.com to request such list. When making such request, please ensure that you have your Notice or proxy card available so that you can prove that you a registered stockholder. Such list will also be available for examination by the stockholders during the whole time of the Annual Meeting at www.virtualshareholdermeeting.com/EDIT2020.

Votes Required to Elect a Director and Ratify Appointment of Ernst & Young LLPApprove Proposals

To be elected, a director must receive a plurality of the votes cast by stockholders entitled to vote aton the meetingelection of directors (Proposal No. 1).

To approve, on an advisory basis, the compensation of our named executive officers (Proposal No. 2), the holders of a majority of the shares voted on the matter and voting for or against such proposal must vote FOR the proposal. Because this vote is advisory and not binding on us or the Board in any way, the Board may decide that it is in our and our stockholders' best interests to compensate our named executive officers in an amount or manner that differs from that which is approved by our stockholders.

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of common stock present or represented by proxy and voted "for" or "against" such matter (Proposal No. 2)3). If your shares are held by your brokerage firm in "street name" and you do not provide voting instructions with respect to your shares, your brokerage firm may vote your shares on Proposal 3. Although stockholder ratification of the audit committee's appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 is not required, we believe that it is advisable to give stockholders an opportunity to ratify this appointment. If this proposal is not approved at the Annual Meeting, the audit committee may reconsider its appointment of Ernst &

Young LLP as our independent registered public accounting firm for the year ended December 31, 2020.

Abstentions and broker non-votes will not be counted as votes cast or votesvoted on any of the proposals. Accordingly, abstentions and broker non-votes will have no effect on the voting on any of the proposals.

Each holder of common stock is entitled to one vote at the Annual Meeting on each matter to come before the Annual Meeting, including the election of directors, for each share held by such stockholder as of the record date. Votes cast in person atvirtually during the Annual Meeting or by proxy by mail, via the Internet or by telephone will be tabulated by the inspector of election appointed for the Annual Meeting, who will also determine whether a quorum is present.

Revoking a Proxy; Changing Your Vote

If you are a stockholder of record, you may revoke your proxy before the vote is taken at the meeting:

If your shares are held in "street name," you may submit new voting instructions by contacting your bank, broker or other organization holding your account. YouStockholders that own stock in "street name" as of such date may alsovirtually attend the meeting and vote in person at the Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, if you obtain a legal proxy from the organization that holds your shares as described inonline while attending the "How to Vote" section above.meeting with your control number included on your voting instruction form.

Your virtual attendance at the Annual Meeting will not automatically revoke your proxy.

Table Questions at the Annual Meeting

If you wish to submit a question on the day of Contentsthe Annual Meeting, beginning at 8:30 a.m. Eastern time, on Wednesday, June 10, 2020, you may log into, and ask a question on, the virtual meeting platform at www.virtualshareholdermeeting.com/EDIT2020. Our virtual Annual Meeting will be governed by our Rules of Conduct which will be posted in advance of the meeting at https://ir.editasmedicine.com/annual-meeting-materials. The Rules of Conduct will address the ability of stockholders to ask questions during the meeting, including rules on permissible topics, and rules for how questions and comments will be recognized and disclosed to meeting participants. All questions received from stockholders during the virtual Annual Meeting will be posted on our investor relations website at https://ir.editasmedicine.com/annual-meeting-materials as soon as practicable following the Annual Meeting.

We will bear the costs of soliciting proxies. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, facsimile, email, personal interviews and other means.

We plan to announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting.

PROPOSAL NO. 1—ELECTION OF THREETWO CLASS I DIRECTORS

Our board of directorsBoard currently consists of seven members.six members, including a chairman of the Board. In accordance with the terms of our restated certificate of incorporation and our amended and restated by-laws, our board of directors is divided into three classes (Class I, Class II and Class III), with members of each class serving staggered three-year terms. The members of the classes are divided as follows:

Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Our restated certificate of incorporation and our amended and restated by-laws provide that the authorized number of directors may be changed only by resolution of our board of directors.Board. Our restated certificate of incorporation and amended and restated by-laws also provide that our directors may be removed only for cause by the affirmative vote of the holders of at least 75% of the votes that all our stockholders would be entitled to cast in an annual election of directors, and that any vacancy on our board of directors,Board, including a vacancy resulting from an enlargement of our board of directors,Board, may be filled only by vote of a majority of our directors then in office.

Our board of directorsBoard has nominated Mr. BorisyMullen and Drs. Cole andDr. Vaishnaw for election as Class I directors at the Annual Meeting. Each of the nominees is presently a director, and each has indicated a willingness to continue to serve as director, if elected. If a nominee becomes unable or unwilling to serve, however, the proxies may be voted for substitute nominees selected by our board of directors.Board.

We have no formal policy regarding board diversity, but our Corporate Governance Guidelines provide that the background and qualifications of the members of our board of directorsBoard considered as a group should provide a significant breadth of experience, knowledge, and ability to assist our board of directorsBoard in fulfilling its responsibilities. Our priority in selection of boardBoard members is identification of members who will further the interests of our stockholders through their established records of professional accomplishment, the ability to contribute positively to the collaborative culture among our boardBoard members, knowledge of our business, understanding of the competitive landscape in which we operate and adherence to high ethical standards. Certain individual qualifications and skills of our directors that contribute to our board of directors'Board's effectiveness as a whole are described in the following paragraphs.

Nominees for Election as Class I Directors

Biographical information, including principal occupation and business experience during the last five years, for our nominees for election as Class I directors at our Annual Meeting is set forth below.

| | Age | |||

|---|---|---|---|---|

| 61 | ||||

Akshay K. Vaishnaw, M.D., Ph.D., has served as a member of our | ||||

57 | ||||

The board of directorsOur Board recommends voting "FOR" the election of Alexis Borisy, Douglas G. Cole, M.D.,James C. Mullen and Akshay K. Vaishnaw, M.D., Ph.D., as Class I directors, for a three-year term ending at the annual meeting of stockholders to be held in 2020.2023.

Any properly submitted proxy will be voted in favor of the nominees unless a contrary specification is made in the proxy. The nominees have consented to serve as directors if elected. However, if any nominee is unable to serve or for good cause will not serve as a director, the persons named in the proxy intend to vote in their discretion for one or more substitutes who will be designated by our boardBoard.

Directors Continuing in Office

Biographical information, including principal occupation and business experience during the last five years, for our directors continuing in office after the Annual Meeting is set forth below.

| | Age | |||

|---|---|---|---|---|

| Class II Directors (Term Expires at | ||||

62 | ||||

Andrew Hirsch has served as a member of our Board since May 2017. Mr. Hirsch is currently the Chief Financial Officer and Head of Corporate Development of Agios Pharmaceuticals, Inc. ("Agios"), a public biotechnology company. Mr. Hirsch has served as Agios' Chief Financial Officer since September 2016 and as its Head of Corporate Development since March 2018. He has more than 22 years of experience in a range of strategic and operating roles in business, including over 17 years in the biotech industry, most recently having served as President and Chief Executive Officer of BIND Therapeutics, Inc., a biotechnology company ("BIND"), from March 2015 until August 2016. Prior to being named President and Chief Executive Officer at BIND, Mr. Hirsch held several other leadership positions at BIND, including Chief Operating Officer from February 2014 to March 2015, and Chief Financial Officer from July 2012 to March 2015. In May 2016, BIND filed a voluntary petition for bankruptcy under Chapter 11 of the United States Bankruptcy Code with the United States Bankruptcy Court. Prior to joining BIND, Mr. Hirsch was Chief Financial Officer at Avila Therapeutics, Inc., a biotechnology company, from | 49 | |||

| | Age | |||

|---|---|---|---|---|

Jessica Hopfield, Ph.D., | 55 | |||

David T. Scadden, M.D., joined our Board in February 2019. Dr. Scadden is the Gerald and Darlene Jordan Professor of Medicine at Harvard University, a position he has held since 2006. Since 1995, Dr. Scadden has practiced at the Massachusetts General Hospital, where he founded and directs the Center for Regenerative Medicine and directed the Hematologic Malignancies Center of the MGH Cancer Center for 10 years. Dr. Scadden co-founded and co-directs the Harvard Stem Cell Institute and is Chairman emeritus and Professor of the Harvard University Department of Stem Cell and Regenerative Biology. He is a member of the National Academy of Medicine and the American Academy of Arts and Sciences and a Fellow of the American College of Physicians and the American Academy for the Advancement of Science. He is a former affiliate member of the Broad Institute of Harvard and the Massachusetts Institute of Technology and is a former member of the Board of External Experts for the National Heart, Lung and Blood Institute, the Board of Scientific Counselors for the National Cancer Institute and Board of Directors of the International Society for Stem Cell Research. Dr. Scadden has served on the boards of Agios since May 2017 and Magenta Therapeutics, Inc., a public biotechnology company, since November 2016, where he is a scientific founder, and private biotechnology companies LifeVault Bio and Clear Creek Bio, Inc. since May 2017 and February 2017, respectively, and is a scientific founder of Fate Therapeutics, Inc., a public | 67 | |||

There are no family relationships between or among any of our directors or executive officers. The principal occupation and employment during the past five years of each of our directors was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our directors and any other person or persons pursuant to which he or she is to be selected as a director.

There are no material legal proceedings to which any of our directors is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Executive Officers Who Are Not Directors

Biographical information for our current executive officers who are not directors is listed below.

| | Age | |||

|---|---|---|---|---|

| Charles Albright, Ph.D., has served as our Chief Scientific Officer since August | ||||

53 | ||||

PROPOSAL NO. 2—RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLPAS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THEFISCAL YEAR ENDING DECEMBER 31, 2017

Our stockholders are being asked to ratify the appointment by the audit committee of the board of directors of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.

The audit committee is solely responsible for selecting our independent registered public accounting firm for the fiscal year ending December 31, 2017. Stockholder approval is not required to appoint Ernst & Young LLP as our independent registered public accounting firm. However, our board of directors believes that submitting the appointment of Ernst & Young LLP to the stockholders for ratification is good corporate governance. If the stockholders do not ratify this appointment, the audit committee will reconsider whether to retain Ernst & Young LLP. If the selection of Ernst & Young LLP is ratified, the audit committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time it decides that such a change would be in the best interest of our company and our stockholders.

A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so and to respond to appropriate questions from our stockholders.

We incurred the following fees from Ernst & Young LLP for the audit of the consolidated financial statements and for other services provided during the years ended December 31, 2016 and 2015.

| | 2016 | 2015 | |||||

|---|---|---|---|---|---|---|---|

Audit fees(1) | $ | 452,500 | $ | 1,251,259 | |||

Audit-related fees | — | — | |||||

Tax fees(2) | 12,330 | 7,500 | |||||

All other fees | — | — | |||||

| | | | | | | | |

Total fees | $ | 464,830 | $ | 1,258,759 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

The aggregate fees included in the Audit Fees are those fees billed for the fiscal year. The aggregate fees included in the Tax Fees are those fees billed in the fiscal year.

Audit Committee Pre-Approval Policy and Procedures

The audit committee of our board of directors has adopted policies and procedures for the pre-approval of audit and non-audit services for the purpose of maintaining the independence of our independent auditor. We may not engage our independent auditor to render any audit or non-audit service unless either the service is approved in advance by the audit committee, or the engagement to render the service is entered into pursuant to the audit committee's pre-approval policies and procedures. Notwithstanding the foregoing, pre-approval is not required with respect to the provision of services, other than audit, review or attest services, by the independent auditor if the aggregate amount of all such services is no more than 5% of the total amount paid by us to the independent auditor

during the fiscal year in which the services are provided, such services were not recognized by us at the time of the engagement to be non-audit services and such services are promptly brought to the attention of the audit committee and approved prior to completion of the audit by the audit committee.

From time to time, our audit committee may pre-approve services that are expected to be provided to us by the independent auditor during the following 12 months. At the time such pre-approval is granted, the audit committee must identify the particular pre-approved services in a sufficient level of detail so that our management will not be called upon to make a judgment as to whether a proposed service fits within the pre-approved services and, at each regularly scheduled meeting of the audit committee following such approval, management or the independent auditor shall report to the audit committee regarding each service actually provided to us pursuant to such pre-approval. The audit committee has delegated to its chairman the authority to grant pre-approvals of audit or non-audit services to be provided by the independent auditor. Any approval of services by the chairman of the audit committee is reported to the committee at its next regularly scheduled meeting.

During our 2016 and 2015 fiscal years, no services were provided to us by Ernst & Young LLP other than in accordance with the pre-approval policies and procedures described above.

The board of directors recommends voting "FOR" Proposal No. 2 to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.

Any properly submitted proxy will be voted in favor of the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017 unless a contrary specification is made in the proxy.

Our The nominating and corporate governance committee of our Board (the "Nominating and Corporate Governance Committee") is responsible for identifying individuals qualified to serve as directors, consistent with criteria approved by our board,Board, and recommending the persons to be nominated for election as directors, except where we are legally required by contract, law or otherwise to provide third parties with the right to nominate.nominate directors.

The process followed by our nominatingthe Nominating and corporate governance committeeCorporate Governance Committee to identify and evaluate director candidates includes requests to boardBoard members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and our board.Board. The qualifications, qualities and skills that our nominatingthe Nominating and corporate governance committeeCorporate Governance Committee believes must be met by a committee-recommended nominee for a position on our board of directorsBoard are as follows:

The nominatingNominating and corporate governance committeeCorporate Governance Committee may use a third party search firm in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate. During 2019, we engaged a third party search firm to identify appropriate director candidates for our Board and such firm identified David T. Scadden, M.D., who was appointed to our Board during 2019.

Stockholders may recommend individuals to the nominatingNominating and corporate governance committeeCorporate Governance Committee for consideration as potential director candidates. Any such proposals should be submitted to our corporate secretary at our principal executive offices and should include appropriate biographical and background material to allow the nominatingNominating and corporate governance committeeCorporate Governance Committee to properly evaluate the potential director candidate and the number of shares of our stock beneficially owned by the stockholder proposing the candidate. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our amended and restated by-laws and must be received by us no later than the date referenced below under the heading "Stockholder

"Stockholder Proposals." Assuming that biographical and background material has been provided on a timely basis, any recommendations received from stockholders will be evaluated in the same manner as potential nominees proposed by the nominatingNominating and corporate governance committee.Corporate Governance Committee. If our board of

directorsBoard determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included on our proxy card for the next annual meeting.

Rule 5605 of the NASDAQNasdaq Listing Rules requires a majority of a listed company's board of directors to be comprised of independent directors within one year of listing. In addition, the NASDAQNasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company's audit, compensation and nominating and corporate governance committees be independent under the Securities Exchange Act of 1934, as amended or the Exchange Act.(the "Exchange Act"). Audit committee members must also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act, and compensation committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. Under Rule 5605(a)(2), a director will only qualify as an "independent director" if, in the opinion of our board of directors,Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries. In order to be considered independent for purposes of Rule 10C-1, the board must consider, for each member of a compensation committee of a listed company, all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director's ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: the source of compensation of the director, including any consulting advisory or other compensatory fee paid by such company to the director; and whether the director is affiliated with the company or any of its subsidiaries or affiliates. In January 2017, our board of directors undertook a review of

Our Board has reviewed the composition of our board of directorsBoard and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directorsBoard has determined that each of Mr. BorisyDrs. Hopfield, Scadden and Drs. Cole, Mendlein, NikolicVaishnaw and VaishnawMessrs. Mullen and Hirsch is an "independent director" as defined under NASDAQNasdaq Listing Rules. Our board of directorsBoard has also determined that Mr. BorisyMessrs. Mullen and Drs. ColeHirsch and Nikolic,Dr. Hopfield, who comprise ourthe audit committee of our Board (the "Audit Committee"), and Drs. Cole, MendleinMessrs. Mullen and Hirsch and Dr. Vaishnaw, who comprise ourthe organization, leadership and compensation committee of our Board (the "Compensation Committee"), satisfy the independence standards for such committees established by the SEC and the NASDAQNasdaq Listing Rules, as applicable. In making such determination, our board of directorsBoard considered the relationships that each such non-employee director has with our company and all other facts and circumstances our board of directorsBoard deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Cynthia Collins served on our Board Committeesfor all of the fiscal year ended December 31, 2019, and Katrine Bosley served on our Board for a portion of such year, but they did not serve on any committee of the Board and were not determined to be independent directors as defined under Nasdaq Listing Rules.

Our board of directorsBoard has established an audit committee, a compensation committee,four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and a nominatingscience and corporate governance committee.technology committee (the "Science and Technology Committee") and may from time to time form such other committees that the Board deems necessary. Each of the audit committee, compensation committee,Audit Committee, Compensation Committee, Nominating and nominatingCorporate Governance Committee and corporate governance committeethe Science and Technology Committee operates under a charter, and each such committee reviews its respective charter at least annually. A current copy of the charter for each of the audit committee, compensation committee,Audit Committee, Compensation Committee, the Nominating and Corporate Governance Committee and the nominatingScience and corporate governance committeeTechnology Committee is posted on the corporate governance section of the "Investors & Media""Investors" section on our website, which is located athttp://www.editasmedicine.com.

Audit Committee

The members of our audit committeethe Audit Committee are Alexis Borisy, Douglas G. Cole, M.D.,Andrew Hirsch, James C. Mullen and Boris Nikolic, M.D.Jessica Hopfield, Ph.D. Mr. BorisyHirsch is the chair of our audit committee.the Audit Committee. Our board of directorsBoard has determined that each of Mr. Borisy and Drs. Cole and NikolicHirsch is independent within the meaning of Rule 10A-3 under the Exchange Act. Our board of directors has determined that we do not have an "audit committee financial expert"expert," as defined byin applicable SEC rules serving on our audit committee. Our board of directors believes that, given the size and stage of development of our company, an audit committee financial expert is not necessary at this time because the collective financial and business expertise of the members of the audit committee is sufficient to satisfy the functions of the audit committee under the terms of the audit committee charter.rules. In making this determination, our board of directorsBoard has considered the formal education and nature and scope of our audit committeethe Audit Committee members' previous experience, coupled with past and present service on various audit committees. Our audit committeeThe Audit Committee assists our board of directorsBoard in its oversight of our accounting and financial reporting process and the audits of our consolidated financial statements. The audit committeeAudit Committee met four9 times during the year ended December 31, 2016,2019, including telephonic meetings. Our audit committee'sThe Audit Committee's responsibilities include:

All audit services to be provided to us and all non-audit services, other thande minimis non-audit services, to be provided to us by our registered public accounting firm must be approved in advance by our audit committee.the Audit Committee.

Organization, Leadership and Compensation Committee

The members of our compensation committeethe Compensation Committee are Douglas G. Cole, M.D., John D. Mendlein, Ph.D., J.D.,James C. Mullen, Andrew Hirsch and Akshay K. Vaishnaw, M.D., Ph.D. Dr. MendleinMr. Mullen is the chair of our compensation committee. Our board of directors has determined that each of Drs. Cole, Mendlein, and Vaishnaw is independent within the meaning of Rule 10C-1 under the Exchange Act. Our compensation committeeCompensation Committee. The Compensation Committee assists our board of directorsBoard in the discharge of its responsibilities relating to the compensation of our executive

Table officers and other members of Contents

officers.senior management. The compensation committeeCompensation Committee met five10 times during the year ended December 31, 2016,2019, including telephonic meetings. Our compensation committee'sThe Compensation Committee's responsibilities include:

The compensation committeeCompensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees, as well as outside advisors or consultants, may be invited by the compensation committeeCompensation Committee to make presentations, to provide financial or other background information or advice, or to otherwise participate in compensation committeeCompensation Committee meetings. No officer may participate in, or be present during, any deliberations or determinations of the compensation committeeCompensation Committee regarding the compensation for such officer or any immediate family member of such officer. The charter of the compensation committeeCompensation Committee grants the compensation committeeCompensation Committee full access to all of our books, records, facilities, and personnel, as well as authority to obtain, at our expense, advice and assistance from internal and external legal, accounting, or other advisors and consultants, and other external resources that the compensation committeeCompensation Committee considers necessary or appropriate in the performance of its duties. In particular, the compensation committee may, in itsCompensation Committee has the sole discretion,authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant's reasonable fees and other retention terms.

The compensation committee engaged Pearl Meyer, as its compensation consultant during 2016. Our compensation committee considered Historically, the relationship that Pearl Meyer has with us, the members of our Board of Directors and our executive officers. Based on the committee's evaluation, the compensation committee has determined that no conflicts of interest exist between the company and Pearl Meyer.

Pearl Meyer assisted the committee in conducting a competitive compensation assessment for our executive officers for the fiscal year ended December 31, 2016, as well as in connection with determination of compensation for executive officers we hired in 2016. In evaluating the total compensation of our executive officers, the compensation committee, with the assistance of Pearl Meyer, established a peer group of 22 publicly traded companies in the biopharmaceutical industry that was comprised of companies whose market capitalization, number of employees, maturity of product development pipeline and area of therapeutic focus are similar to ours.

Pearl Meyer also supplemented the peer group information with published survey data, which provided a broader market representation of companies and deeper position reporting.

Historically, our compensation committeeCompensation Committee reviews all compensation components including base salary, bonus, benefits and equity incentives, and other perquisites, as well as severance arrangements, change-in-control benefits and other forms of executive officer compensation and provides a

recommendation to the Board on the compensation of our Chief Executive Officer and our otherchief executive officers to our board of directors.officer. In addition, the compensation committeeCompensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of our compensation strategy, potential

modifications to that strategy, and new trends, plans, or approaches to compensation, at various meetings throughout the year. The compensation committeeCompensation Committee also makes recommendations to our board of directorsBoard regarding the compensation of non-employee directors and has the authority to administer our equity-based plans.

Under its charter, the compensation committeeCompensation Committee may form, andfrom time to time delegate authority to subcommittees consisting of independent directors, as it deems appropriate. Pursuant to our 2015 Stock Incentive Plan, the compensation committeeCompensation Committee has delegated to our Chief Executive Officerchief executive officer the authority to approve grants of stock options to employees who are not executive officers subject to certain limitations for each level of employment and an annual aggregate maximum amount of awards that can be granted pursuant to such delegated authority.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves, or in the past has served, as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our board of directors or our compensation committee. Dr. Bitterman, a member of our compensation committee from January 2016 to January 2017, served as our President from November 2013 until June 2014.

Nominating and Corporate Governance Committee

The members of our nominatingthe Nominating and corporate governance committeeCorporate Governance Committee are Douglas G. Cole, M.D., John D. Mendlein,James C. Mullen, Jessica Hopfield, Ph.D., J.D., and Boris Nikolic,David T. Scadden, M.D. Dr. MendleinMr. Mullen is the chair of our nominatingthe Nominating and corporate governance committee.Corporate Governance Committee. The nominatingNominating and corporate governance committeeCorporate Governance Committee met three6 times during the year ended December 31, 2016,2019, including telephonic meetings. Our nominatingThe Nominating and corporate governance committee'sCorporate Governance Committee's responsibilities include:

Science and Technology Committee

The members of the Science and Technology Committee are Jessica Hopfield, Ph.D., David T. Scadden, M.D. and Akshay K. Vaishnaw, M.D., Ph.D. Dr. Vaishnaw is the chair of the Science and Technology Committee. The Science and Technology Committee met 5 times during the year ended December 31, 2019. Our Science and Technology Committee's responsibilities include:

Board and Committee Meetings Attendance

The full board of directorsBoard met 1411 times during 2016.2019. During 2016,2019, each member of the board of directors, other than Dr. Cole,Board attended in person or participated in 75% or more of the aggregate of (i) the total number of meetings of the board of directorsBoard (held during the period for which such person has been a director) and (ii) the total number of meetings held by all committees of the board of directorsBoard on which such person served (during the periods that such person served).

Director Attendance at Annual Meeting of Stockholders

Although we do not have a formal policy regarding attendance by members of our board of directorsBoard at our annual meeting of stockholders, we encourage all of our directors to attend. We did not hold anAll members of our Board attended our 2019 annual meeting of stockholders, during the time we were a public company in 2016.except Mr. Hirsch.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is posted under the heading "Corporate Governance" on the Investors & Media section of our website, which is located athttp://www.editasmedicine.com. If we make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Corporate Governance Guidelines

Our board of directorsBoard has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. The guidelines provide that:

A copy of the corporate governance guidelines is posted under the heading "Corporate Governance" on the Investors & Media section of our website, which is located athttp://www.editasmedicine.com.

Board Leadership Structure and Board's Role in Risk Oversight

Our amended and restated by-laws and Corporate Governance Guidelines provide In March 2018, our board of directors with flexibility to combine or separate the positions of ChairmanBoard appointed James C. Mullen, an independent director under applicable Nasdaq rules, as chairman of the Board, and Chief Executive Officer and/ora role he has served in since then. Prior to implement the role of Lead Independent Director in accordance with its determination that utilizing one or the other structure would be in the best interests of our company. At this time,Mr. Mullen's appointment, we dodid not have a Chairmanchairman of the Board. Mr. Mullen's duties as chairman of the Board include determining the frequency and length of board meetings, recommending when special meetings of the Board should be held, preparing or approving the agenda for each Board meeting, chairing meetings of our independent directors, meeting with any director who is not adequately performing his or her duties as a member of the Board or a Lead Independent Director.any committee of the Board, facilitating communications between management and the Board, and assisting with other corporate governance matters. Our board

Board believes that separating the duties of the chairman of the Board from the duties of our chief executive officer enhances the Board's oversight of, and independence from, management, while also allowing our company ischief executive officer to focus on our day-to-day business operations instead of Board administration. The Board evaluates our Board leadership structure from time to time and may recommend or implement further alterations of this structure in the responsibility of our board of directors as a whole, and this responsibility can be properly discharged without a Chairman and Lead Independent Director.future.

Risk is inherent with every business and how well a business manages risk can ultimately determine its success. We face a number of risks, including those described under "Risk Factors" in our 20162019 Annual Report.Report and in the other reports we file with the SEC from time to time. Our board of directorsBoard is actively involved in oversight of risks that could affect us. This oversight is conducted primarily by our full board of directors,Board, which has responsibility for general oversight of risks. Our board of directorsBoard oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis and our boardBoard and its committees oversee the risk management activities of management. Our board of directorsBoard satisfies this responsibility through full reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our company. Our audit committeecompany, including those related to any potential security breaches. The Audit Committee oversees risk management activities related to financial controls, and legal and compliance risks and cybersecurity risks. Our compensation committeeThe Compensation Committee oversees risk management activities relating to our compensation policies and practices. Our nominatingpractices, our organizational health and corporate governance committeesuccession planning for the members of our senior management. The Nominating and Corporate Governance Committee oversees risk management activities relating to boardour Board's composition and management succession planning.planning for our chief executive officer. In addition, members of our senior management

team attend our quarterly boardBoard meetings and are available to address any questions or concerns raised by the boardBoard on risk management and any other matters. Our board of directorsBoard believes that full and open communication between management and the board of directorsBoard is essential for effective risk management and oversight.

Communication with Our Directors

Any interested party with concerns about our company may report such concerns to the board of directors or otherwise the chairman of the nominating and corporate governance committee,our Board by submitting a written communication to the attention of such directorour corporate secretary or the chairman of the Board at the following address:

c/o Editas Medicine, Inc.

11 Hurley Street

Cambridge, Massachusetts 02141

United States

You may submit your concern anonymously or confidentially by postal mail. You may also indicate whether you are a stockholder, customer, supplier, or other interested party.

A copy of any such written communication may also Communications will be forwarded to our legal counsel and a copy of such communication may be retained for a reasonable period of time. The director may discuss the matter with our legal counsel, with independent advisors, with non-management directors, or with our management, or may take other action or no action as the director determines in good faith, using reasonable judgment, and discretion. Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the chairman of the boardBoard (if one is appointed and is an independent director), the lead director (if one is appointed) or otherwise the chairman of the nominating and corporate governance committee, subject to the advice and assistance of counsel, consider to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or duplicative communications.

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Overview

This section discusses the principles underlying our policies and decisions with respect to all material elements of the compensation of our named executive compensation policies for our "named executive officers" and the most important factors relevant to an analysis of these policies. It provides qualitative information regarding the manner and context in which compensation is awarded to and earned by ourofficers.

Our named executive officers named infor the "Summary Compensation Table" below, or our "named executive officers," and is intended to place in perspective the data presented in the following tables and the corresponding narrative.

2016 Summary Compensation Table

The following table sets forth information regarding compensation earned by our President and Chief Executive Officer during thefiscal year ended December 31, 20152019, were:

During 2019, we experienced significant management changes. In early 2019, we announced that Ms. Bosley would be leaving Editas on March 1, 2019 and that Ms. Collins, then a director of our company, would be appointed as interim chief executive officer. Previously, in December 2018, Dr. Hack, our previous chief financial officer, had announced his resignation effective March 1, 2019 and we engaged FTI Consulting, Inc. ("FTI") for the services of Mr. Ek, who served as our interim chief financial officer from March 2019 until January 8, 2020.

In August 2019, we announced that Ms. Collins had accepted the position as our permanent chief executive officer. Additionally, in August 2019, Dr. Albright, who has served as our chief scientific officer since 2016, was promoted to the position of executive vice president and chief scientific officer. In October 2019, Dr. Abrams joined us as chief medical officer. In addition, in October 2019, Dr. Myer left our company. On January 9, 2020, Michelle Robertson joined as our chief financial officer.

For a discussion of the compensation paid to Ms. Collins, Dr. Abrams, Mr. Ek and Ms. Bosley, please see "—Compensation of Our New Chief Executive Officer, Chief Scientific Officer and" "—Compensation of Our New Chief Medical Officer, during" and "—Employment, Severance, Change in Control Arrangements, Separation and Consulting Arrangements." The compensation we agreed to pay Ms. Collins resulted from negotiations between our Compensation Committee and Ms. Collins, and reflects the year ended December 31, 2016.

Name and Principal Position | Year | Salary ($) | Option Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | Total ($) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Katrine S. Bosley(3) | 2016 | 450,000 | 429,255 | 222,750 | 1,102,005 | |||||||||||

President and Chief Executive Officer | 2015 | 386,200 | — | 121,653 | 507,853 | |||||||||||

Charles Albright, Ph.D.(4) | 2016 | 136,538 | 2,506,028 | 44,297 | 2,686,863 | |||||||||||

Chief Scientific Officer | ||||||||||||||||

Gerald Cox, M.D., Ph.D. | 2016 | 100,000 | 2,367,450 | — | 2,467,450 | |||||||||||

Chief Medical Officer(5) | ||||||||||||||||

As a cash bonus award earned by our President and Chief Executive Officer during 2015 andresult of these special circumstances, the compensation paid to her in 2016.

Narrative Disclosure to Summary Compensation Table

Base Salary. In 2016, we paid an annual base salary of $450,000 toAbrams, Ms. Bosley and $136,538Mr. Ek varies from the compensation for our other named executive officers and $100,000 to Drs. Albright and Cox, which represents a pro rata portion of an annual base salary of $375,000 and $400,000, respectively. In 2015, we paid an annual base salary of $386,200 to Ms. Bosley.from

our historical practices. In addition, Ms. Bosley, Dr. Hack and Mr. Ek were not included in the annual compensation review undertaken by the Compensation Committee in 2019 and are excluded from the discussion below under "—Executive Compensation Elements & Decisions."

Say-on-Pay Vote Results

At our 2019 annual meeting of stockholders, we conducted a non-binding advisory vote on the compensation of our named executive officers, commonly referred to as a "say-on-pay" vote, in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Over 96% of the votes cast by stockholders on this proposal, excluding broker non-votes and abstaining votes, were cast in support of the compensation paid to our named executive officers. While this vote is a non-binding advisory vote, our Compensation Committee and Board take the voting results into account in determining the compensation of our named executive officers. Given the strong level of support evidenced by last year's say-on-pay vote, among other factors, and except for compensation paid to named executive officers that served on an interim basis or were hired in 2019, our Compensation Committee decided to maintain our general approach to executive compensation and made no significant changes to our executive compensation program this year.

Our Compensation Committee and Board will continue to consider stockholder input and monitor our executive compensation program to ensure it aligns the interests of our named executive officers with the interests of our stockholders and adequately addresses any stockholder concerns that may be expressed in future votes. Consistent with the recommendation of our Board and the preference of our stockholders as reflected in the non-binding advisory vote on the frequency of future "say-on-pay" votes conducted at our 2019 annual meeting of stockholders, our stockholders will have an opportunity annually to cast an advisory vote in connection with compensation for our named executive officers.

About Editas Medicine

We useare a leading, clinical stage genome editing company dedicated to developing potentially transformative genomic medicines to treat a broad range of serious diseases. Our mission is to translate the promise of genome editing into a broad class of differentiated, transformational medicines for diseases of high unmet need.

Compensation Objectives and Philosophy

Our compensation programs are designed to attract and retain qualified and talented executives, motivate such executives to achieve our business goals and reward them for short-and long-term performance with a simple and clear compensation structure. To achieve its objectives, the

Compensation Committee structures our executives' compensation with a number of elements, each with its own focus and purpose.

Element of Pay | Purpose | Targeted Market Positioning | ||

|---|---|---|---|---|

| Base Salary | Provide a fixed amount of compensation that reflects each executive's role, level of experience, and performance. | Within a competitive range | ||

Annual Performance-based Cash Bonuses | Motivate the achievement of business goals that the Compensation Committee believes are important to the overall success of the business and will enhance stockholder value over time. | 50th Percentile | ||

Equity Incentives | Assist in retaining our named executive officers and aligning their interests with those of our stockholders by allowing them to participate in the longer-term success of our company as reflected in the appreciation of our stock price. | 50th Percentile | ||

Other Benefits | Provide benefits, including severance, to our named executive officers that protect their health and welfare and allow them to focus on achieving our mission and objectives. | Within a competitive range |

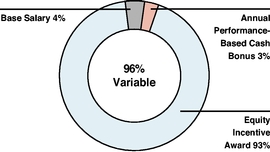

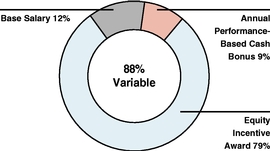

The Compensation Committee retains the authority and flexibility to vary the compensation of any individual named executive officer from the targeted pay framework, based on the unique responsibilities and requirements of his or her position, his or her experience and qualifications, internal parity relative to similar positions within our company, and individual or company performance relative to performance goals and our selected peer group to ensure appropriate pay-for-performance alignment. While we do not have a formal or informal policy for allocating between long-term and short-term compensation, between cash and non-cash compensation or among different forms of non-cash compensation, historically, a majority of the compensation for our named executive officers is long-term compensation, balanced with sufficient short-term incentives to encourage consistently strong performance. The charts below illustrate the balance of compensation for Ms. Collins, our current chief executive officer, based on the annualized compensation paid to her in her capacity as our permanent chief executive officer in 2019, and for Drs. Albright and Abrams, the two other named executive officers that remain officers of our company.

| CEO 2019 Compensation Mix(1) | Average of Other Named Executive Officers 2019 Compensation Mix | |

|  |

officer during 2019. Additionally, her base salary and performance-based cash bonus for her service as our permanent chief executive officer during 2019 has been annualized for purposes of this graph.

Executive Compensation Process

Role of our Compensation Committee. The Compensation Committee is responsible for, among other things, reviewing and approving, or recommending for approval by our Board, the compensation of our executive officers and our senior management, including salary, bonus and incentive compensation levels, equity compensation (including awards to induce employment), severance arrangements, change-in-control benefits and other forms of executive officer compensation. A full description of the Compensation Committee's role and responsibilities is in the Compensation Committee's charter, which is available on our website.

Role of Management. As a part of determining named executive officer performance and compensation, the Compensation Committee receives recommendations from our chief executive officer (except with respect to her own compensation and performance). Our chief executive officer's performance and compensation is approved by our Board based upon the recommendation of the Compensation Committee. The evaluation of each of our named executive officers is based on our overall corporate performance against annual goals that are approved by our Board at the beginning of each year, as discussed in more detail below. At the invitation of the Compensation Committee, certain members of our senior management also participate in Compensation Committee meetings to share their perspective and relevant information on topics that the Compensation Committee is discussing.

Role of the Compensation Committee's Independent Compensation Consultant. The Compensation Committee has the sole authority to retain, at our expense, one or more third-party compensation consultants to assist the committee in performing its responsibilities. The Compensation Committee may terminate the services of the consultant if the Compensation Committee deems it appropriate. The Compensation Committee utilized the services of Pearl Meyer & Partners, LLC ("Pearl Meyer") to assist it in fulfilling its responsibilities in 2018, 2019 and 2020. Pearl Meyer was retained exclusively by the Compensation Committee and has not been retained by management to perform any work for our company other than projects performed at the direction of the Compensation Committee. Pearl Meyer provided analysis and recommendations regarding:

Pearl Meyer advised the Compensation Committee on all the principal aspects of executive compensation, including executive new hire compensation arrangements. Pearl Meyer consultants attended meetings of the Compensation Committee, including executive sessions in which executive compensation issues are discussed, when requested to do so. Pearl Meyer reported to the Compensation Committee and not to management, although it met with management for purposes of gathering information for its analyses and recommendations. The Compensation Committee annually evaluates its engagement of compensation consultants, and selected Pearl Meyer to advise with respect to compensation matters based on Pearl Meyer's industry experience and reputation, which the Compensation Committee concluded gave Pearl Meyer useful context and knowledge to advise it. The Compensation Committee has assessed the independence of Pearl Meyer pursuant to SEC and Nasdaq

rules and concluded that no conflict of interest exists that would prevent Pearl Meyer from independently advising the Compensation Committee.

Defining and Comparing Compensation Benchmarks. The Compensation Committee benchmarks our executive compensation against a peer group of companies to determine competitiveness and market trends. The Compensation Committee reviews the companies in our peer group annually, reviews Pearl Meyer's recommendations regarding which companies should be included in the peer group and makes adjustments as necessary to ensure the peer group continues to properly reflect the market in which we compete for talented executives. The Compensation Committee also annually reviews the executive pay practices of other similarly-situated companies as reported by Pearl Meyer through industry surveys and proxy analysis. These surveys are specific to the biopharmaceutical and biotechnology sector. The Compensation Committee requests customized reports of these surveys so that the compensation data reflect the practices of companies that are like us. The Compensation Committee considers this information when making determinations or recommendations for each element of compensation for our named executive officers.

In developing the peer group of companies to inform 2019 compensation decisions, our Compensation Committee, with the assistance of Pearl Meyer, established a peer group of 20 publicly traded, national and regional companies in the biopharmaceutical industry that was selected based on two categories of companies:

Based on these criteria, our peer group for 2019 was comprised of the following companies:

| Agios Pharmaceuticals, Inc. | Blueprint Medicines Corporation | Sangamo Therapeutics, Inc. | ||

Acceleron Pharma Inc. | CRISPR Therapeutics AG | Seres Therapeutics, Inc. | ||

Adverum Biotechnologies, Inc. | Epizyme, Inc. | Spark Therapeutics, Inc. | ||

Akebia Therapeutics, Inc. | Fate Therapeutics, Inc. | Syros Pharmaceuticals, Inc. | ||

Arrowhead Pharmaceuticals, Inc. | Intellia Therapeutics Inc. | Voyager Therapeutics, Inc. | ||

Audentes Therapeutics, Inc. | Regenxbio Inc. | WAVE Life Sciences Ltd. | ||

bluebird bio, Inc. | Sage Therapeutics, Inc. |

Twelve of the twenty peer companies were determined to be focused in the gene editing or therapy space and the remaining eight peer companies were other local companies that potentially competed with us for qualified employees. The peer group was reviewed for reasonableness based on the following aggregate size statistics:

Company | Market Capitalization (Dollar Amounts in Millions)(1) | Research and Development Expenses (Dollar Amounts in Millions)(2) | Number of Employees(3) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Median Company in 2019 Peer Group | $ | 1,404 | $ | 92 | | 139 | ||||

Editas | $ | 1,467 | $ | 101 | 112 | |||||

In evaluating the compensation of our named executive officers for 2019, Pearl Meyer also compared the compensation of select named executive officers to a broader biotechnology industry group, with a focus on public biopharmaceutical companies that were of an equivalent size as our company.

The Compensation Committee believed the compensation practices of our peer group provide us with appropriate compensation benchmarks for evaluating the compensation of our named executive officers. Notwithstanding the similarities of the peer group to our company, due to the nature of our business, we compete for executive talent with many companies that are larger and more established than we are or that possess greater resources than we do, as well as with prestigious academic and non-profit institutions. Other considerations, including market factors, the experience level of the executive and the executive's performance against established corporate goals and individual objectives, may require that the Compensation Committee vary from its historic compensation practices or deviate from its general compensation philosophy under certain circumstances.

For the purposes of informing 2020 compensation decisions, the Compensation Committee, with the advice of Pearl Meyer, examined our peer group list using the same criteria as the previous year and approved the following companies as our 2020 peer group:

| Acceleron Pharma Inc. | Blueprint Medicines Corporation | Regenxbio Inc. | ||

Adverum Biotechnologies, Inc. | CRISPR Therapeutics AG | Rubius Therapeutics, Inc.* | ||

Allogene Therapeutics, Inc.* | Epizyme, Inc. | Sangamo Therapeutics, Inc. | ||

Arrowhead Pharmaceuticals, Inc. | Fate Therapeutics, Inc. | Syros Pharmaceuticals, Inc. | ||

Audentes Therapeutics, Inc. | Homology Medicines, Inc.* | Voyager Therapeutics, Inc. | ||

AVROBIO, Inc.* | Intellia Therapeutics Inc. | WAVE Life Sciences Ltd. | ||

bluebird bio, Inc. | Magenta Therapeutics, Inc.* |